eRecording is here to stay; so is human error.

SEYMOUR, TN–Here’s a failure of title, 21st century style.

Richard and Deana Greene were owners of this newer home in the Smoky Mountains of Tennessee.

In February 2009 the couple borrowed $204,517 from Homeowners Mortgage, giving a deed of trust against the property.

The title agent was Network Closing Services, a company offering regional services through affiliates in 21 states. Network Closing got the deed of trust signed and notarized, and delivered it to Simplifile, an electronic recording agent. Simplifile provides electronic recording services, converting paper documents into digitized images for transmittal via the Internet to local recording offices.

Sevier County Courthouse, home to the Register of Deeds. The statue on the courthouse lawn honors Dolly Parton

The Greene property is located in Sevier County, TN. The Sevier County Register of Deeds has a vendor relationship with Business Information Systems (B.I.S.), so the Register’s office only accepts imaged documents that are formatted and transmitted through B.I.S.

So it happened that this deed of trust went from Network Closing to Simplifile, then from Simplifile to B.I.S., and then from B.I.S. to the Register of Deeds.

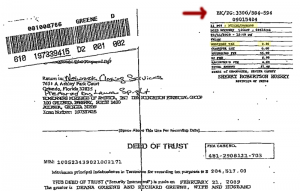

The imaged deed of trust was received by the Register’s office on March 11, 2009. It was reviewed by Deputy Register Lois McMurry, who with a keystroke accepted the document and assigned it Instrument Number 09015404, recorded March 11, 2009, at Book 3300, Page 584.

But perhaps she had been too hasty. Before moving on, Ms. McMurry noticed the document had been mislabeled in a data field affixed by B.I.S. for the Register’s use, as “Miscellaneous” instead of “Deed of Trust,” and the Tennessee mortgage tax had not been paid. So she deleted the recording and returned the deed of trust to B.I.S. with advice it was rejected, but it still showed the recording information (Instrument Number, recorded date, and Book and Page numbers).

Moving on, Ms. McMurry re-assigned this identical recording information to the next document in her queue.

B.I.S. got the deed of trust and forwarded it to Simplifile, but failed to report it was unrecorded. Had Simplifile known, they would have advanced the mortgage tax payment and backcharged Network Closing.

The Greenes filed a Chapter 7 bankruptcy in June 2009, and their court-appointed Trustee in bankruptcy filed an adversary proceeding to avoid the unrecorded deed of trust as an interest in the Greene property. Mainly, the Trustee based his action on Bankruptcy Code section 544(a)(3), which allows a trustee to avoid an interest in debtor real property that is not perfected as of commencement of bankruptcy. This is the so-called “trustee avoiding power,” or “strong arm power.” (See our posting for May 22, 2010, “Bankruptcy 101.”)

The Trustee argued the deed of trust was not “perfected,” because there’s no record of it in county land records. The lender (Bank of America, as current holder of the loan) replied the deed of trust was duly recorded, and therefore perfected, because Tennessee law states that a document once accepted for recording cannot later be removed from land records for failure to pay a fee or tax.

The bankruptcy court ruled in favor of the Trustee, allowing that even though Ms. McMurry’s actions were “improper and contrary to statute,” the result was the deed of trust disappeared from Sevier County land records. And, the court concluded, intervening rights of the trustee in bankruptcy prevail over expectations of the lender.

So the lender loses its security, and becomes just another unsecured creditor.

Moral: We’ve said it before, “There’s no crying in bankruptcy.”

The risk that a mortgage or deed of trust is invalid or unenforceable against security property is typically covered by title insurance.

The case is In re Greene (Newton v. Bank of America), 2011 WL 864971 (Bkrtcy,E.D.Tenn. 2011).

The rejected deed of trust, as returned to Simplifile and Network Closing. Note entries in the data field, upper right, as "Miscellaneous" and "zero" mortgage tax (yellow). Note also recording information (red arrow). (Click to enlarge)